No one is able to predict the future with absolute certainty, especially when considering something as multifaceted as today’s real estate market. That being said, I believe future buyers and sellers can give themselves a competitive edge by having a basic understanding of the trends and predictions for the year. I want you to feel as empowered and educated when we work together so that you can feel total peace of mind about your decisions. To make this goal a reality, I’ve gathered some tidbits of trends, predictions, and advice about what to expect in 2024.

Remember

I always advise getting in touch with me for a personalized opinion on specific areas instead of applying this article as a universal truth. As someone who has nearly seen it all in my 20 years of real estate, I can give you a good idea of what factors might uniquely affect the areas you’re interested in.

I am always just a text, phone call, or email away!

#1 Mortgage rates will likely decrease, but slower than hoped for

While many are still shocked by the mortgage rates from 2023 that reached two-decade highs, there is no clear sign on the horizon that rates will drop dramatically in the the near future. As detailed in a 2024 overview from Keller Williams,

"prospective homebuyers should expect rates to settle at between 6% and 6.5%...the Federal Reserve has indicated that they are committed to keeping interest rates higher for longer."

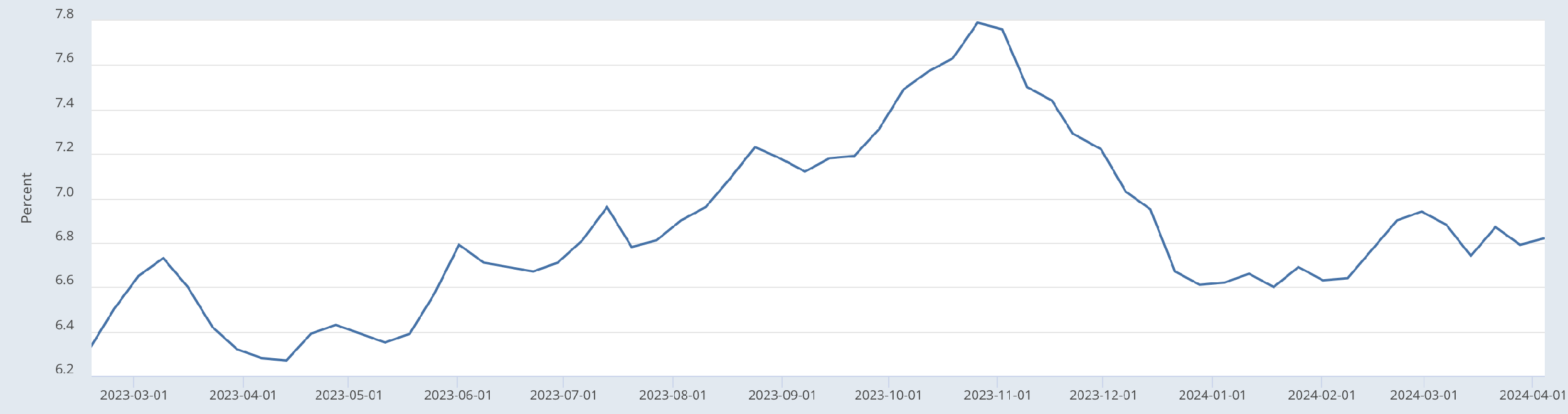

Observe the the trends in this graph from Freddie Mac, displaying the 30 year fixed mortgage rate average from March 2023 to April 2024.

#2 Prices will be stable, moderately increasing

It is widely predicted that home prices will make a slow and steady incline.

A Forbes Article on the 2024 Housing market paints a picture of the pricing situation:

"With many homeowners “locked in” at ultra-low interest rates or unwilling to sell due to high home prices, demand continues to outpace housing supply—and likely will for a while—even as some homeowners may finally be forced to sell due to major life events."

So while inventory is projected to marginally increase, any resulting fall in prices will likely be offset by new buyers entering the market.

#3 Affordability will continue to be a large factor

Affording a home will continue to be a huge factor for households, especially younger ones.

As the priorly mentioned Forbes article states,

"home prices and homeownership expenses continue to outpace wage growth."

While this makes homeownership unattainable for many, lowering rates could allow some households to enter the market that had been holding off previously. The pent-up demand of this home-seeking millennial generation, marginally declining rates, and a marginally increasing home inventory could have two major effects on the market:

1. Keeping prices up and the process competitive

2. Keeping some households out of the buying market completely because prices are too out of reach.

All in All

No one can tell the future, but all future buyers and sellers could benefit from getting a feel for their area's recent market patterns. That way, when you're ready to make your move, you can enter into discussions with your real estate agent from an informed and realistic point of view. Working with a trusted local real estate agent is the best move to land yourself a great deal, as they are the ones navigating the ins and out of local deals on a daily basis.